.png)

.png)

Outsourcing your credit control operations to Invoice Legal.

Understanding constraints on small business owners.

Dealing with overdue and outstanding commercial invoices internally can be a big struggle, especially if you’re a small business with limited resources and therefore do not have a dedicated credit control department who can deal with accounts receivable and accounts payable. Even then many business which have a billing department often fall into a rut with certain troublesome business customers and simply put it up with getting paid late as a necessary evil to doing business with them. For many businesses the risk of getting into conflict regarding outstanding invoices and risk losing business is a line many dare not cross.

Avoiding the issue and becoming accustomed to receiving invoice payments late is very common within small businesses. A lax paying business customer needs to be challenged albeit in a professional and polite way. Changing this culture can unlock the door to getting invoices paid on time and improving your businesses cash flow position.

Changing your invoicing and billing culture can be difficult especially if your business has become accustomed to paying invoices at their own pace. Shaking things up can cause a little friction but outsourcing this to a third-party such as Invoicey can smoothen this transition and help deflect some of the more difficult aspects onto us. Whilst we work for you, we mediate between you and your business clients as clear and direct communication is often key to setting down new payment terms – it helps us find resolutions more quickly and brings about quicker payments solving issue so that you ultimately get paid quicker.

The Invoicey accounts ledger is a robust platform which enables you , the business supplier to set clear terms and conditions and have all your billing matters organised into one central system where your customers can log in and clearly see invoices coming due and past due with additional payment reminder features etc so that there can be no ambiguity as to when invoices come due. What’s more having a robust system in place which automates the entire process and leaves digital footprint per each communication means your customers are less likely to use stall tactics or lax procedures as a reason for not paying on time.

Whilst our platform does enable you to deal with customers individually on a case-by-case basis the burden of managing billing is taken out of your hands so you are less likely to feel pressured and give in to customers making unreasonable demands to further increase payment terms to suit their cash flow. Instead your business customers are more likely to abide by your payment terms when there is a set structure in place which is clear and transparent right from the outset.

Our purpose built technology uses advanced AI and Nudge Techniques to a) recover your invoice debts and b) to limit future repeat scenarios so that bad habits are broken. We do this by implementing a number of features.

Discounting incentives which are time sensitive therefore nudging your business customer to pay early. This is displayed using visually striking radial graphs which countdown the number of days per each invoice is due and the number of days a discount incentive is offered.

Our unique Invoicey Scoring system is a barometer which directly responds to when invoice payments are made. Business customer scores increase when they make payments early or on time and decreases when they make persistent late payments again to incentivise an early payment culture.

Our automated email notifications can be set at optimal times of the day to give it the best chance of being seen by your business customer and act as an effective timely reminder that your Invoice needs paying. Customers can pay using direct payment links, and view literature explaining the reasons behind each email and at what stage in the process you are at. This can then be escalated per each email so that your business customer is kept on their toes.

Recurring billing enables you to set an invoice to a specific date which is crucial when adhering to strict payment terms. You have to set the example by sticking to an effective system. After all if you are lax then your customer may also think they too can be lax in paying. Having a set date which you are billed each week or months takes away any ambiguity and excuses that your business customer can make for not paying.

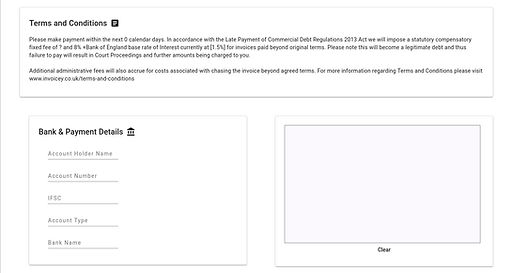

We also apply Terms and Conditions referencing the late payments act 2013 which automatically updates with live Bank of England Interest Rates so your customers are fully aware that they can be charged late invoice charges and additional interest if the invoice becomes overdue.

Understandably it may feel frustrating to pay out more money just to retrieve monies rightfully owed to you from outstanding invoices. However, we do not charge any upfront fees and all our invoice ledger features are free to use in the first instance. Additionally in most cases we are able to retrieve funds and are still a much cheaper option than trying to recuperate monies yourself, especially when you factor in possible extra time and resources spent.